Welcome to ASIQS

About us

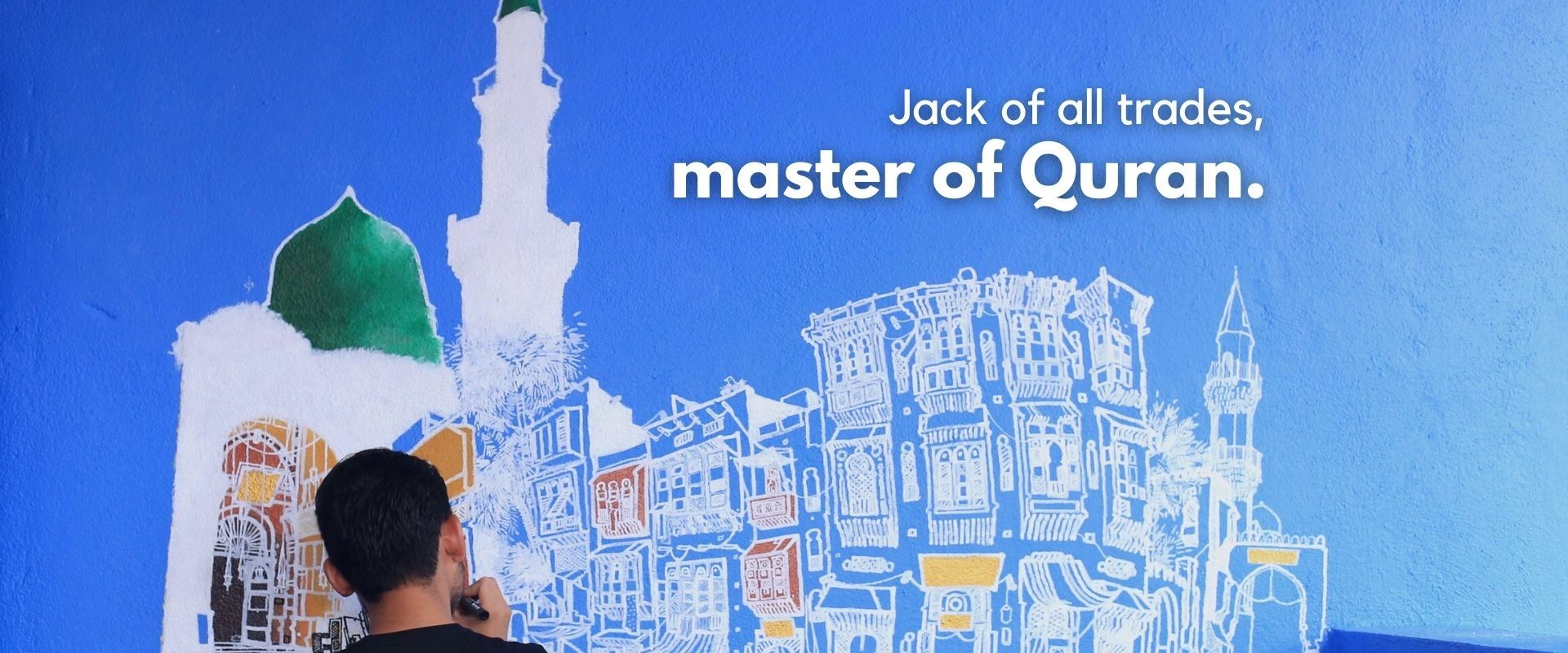

Ash Shura Institute of Quranic Sciences(ASIQS) is a private K-12 (primary and secondary) daily school that specializes in teaching Quranic Sciences to students aged 7 to 18 years old. We are a registered Tahfiz school under Jabatan Agama Islam Selangor.

ASIQS also provides students with qualifications to pursue higher education and vocational training. Our graduates have gone on to enroll in reputable universities such as Universiti Teknologi Petronas, UIAM, UiTM, and more, pursuing courses in Engineering, Medicine, Occupational Therapy, Islamic Finance, and the Association of Chartered Certified Accountants.

At ASIQS, we strike a balance between teaching Quranic Sciences and preparing our students for higher education. Our curriculum is designed to provide a strong foundation in Quranic Sciences while also equipping our students with the necessary qualifications to pursue higher education and vocational training.

We believe that a strong grounding in Quranic Sciences will not only benefit our students spiritually, but also intellectually, as it instills values such as discipline, critical thinking, and perseverance. Our graduates have gone on to excel in various fields of study, and we are proud to have played a part in their success.

Brief History

Founded in 2012

ASIQS was founded as a joint venture with an established Islamic school in Shah Alam. Originally named As Syakirin Institute of Quranic Sciences, we became an independent school after a year and were renamed Ash Shura Institute of Quranic Sciences.

From 36 students to 200

Starting with only 36 students, we have grown to 200 students in 2022 and relocated several times to accommodate our increasing numbers. Finally, we found our home in a 20,400 sqft building in Space U8, Bukit Jelutong. .

Our culture remains

As one of our parents put it, "ASIQS is a small, familial school with a very big heart." And we couldn't agree more! .

Our Services

ASIQS Elementary School

ASIQS Junior High School

ASIQS Junior High School

- Equivalent to Cambridge Key Stage 2

- For 6-12 years old

- From 8.00 am to 4.00 pm

- Quranic studies infused in Montessori Cosmic Education plus KAFA and KSSR Bahasa Melayu Curriculum

ASIQS Junior High School

ASIQS Junior High School

ASIQS Junior High School

- Equivalent to Cambridge Key Stage 3

- For 12-15 years old

- From 8.00 am to 4.30 pm

- Quranic Sciences curriculum plus Common Core English, Mathematics and KSSM Bahasa Melayu syllabus.

ASIQS Senior High School

ASIQS Junior High School

ASIQS Senior High School

- Equivalent to Key stage 4 & 5.

- For 15-18 years old

- From 8.00am up to 10.00pm based on chosen stream.

- Consist of Core High School Module and 4 streams to choose from : TVET/Internal, IGCSE, SPM and US High School Diploma.

Facilities

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.